managing your money

What are you like when it comes to spending your pocket money – do you tend to spend it in one go, or save it up for a rainy day?

In a recent student survey conducted by Save the Student, 77% of students wish they’d had a better financial education before coming to uni.

We’ve created this e-module to help you manage your money and hopefully save a bit too.

HOW MUCH DOES IT COST TO LIVE INDEPENDENTLY?

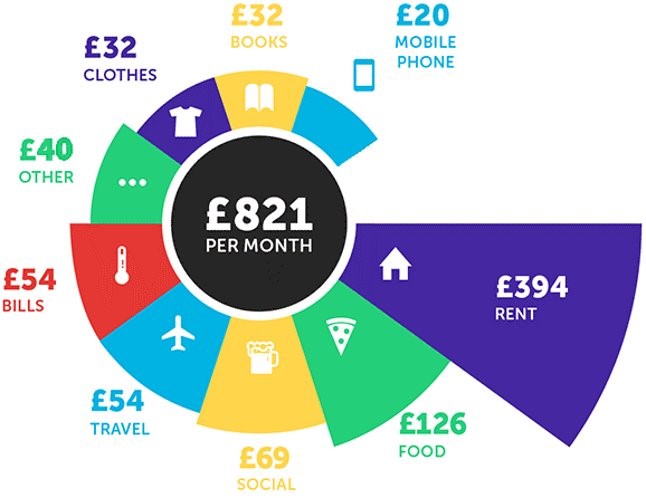

Below is a snapshot of the approximate monthly costs of living away from home whilst studying at university. Obviously this will increase if you choose to live in an expensive university city such as London or Cambridge and be a lot less if you choose a university in cheaper areas of the country such as Bangor (in Wales) or Manchester. Take a look at this article which shows the most expensive and cheapest university towns in 2019.

Have a look at the graph below. What sort of costs do you think “Other” might include?

Some examples might be subscriptions such as for student societies, Netflix, or a gym membership. Not forgetting presents for your friends and family, as well as other costs if you run a car, for example (petrol, MOT, maintenance, etc). It all adds up!

WHAT WILL MY WEEKLY COSTS BE?

The University of Surrey offers a useful guide to weekly living costs in Surrey. We’ll also show you how to work out your weekly budget later on.

CAN I GET ANY HELP?

Before you start university, it’s a good idea to apply for student loan. If you are a UK student, you may be eligible for a tuition fee loan which covers the cost of your course and also a maintenance loan, which covers your living expenses. Students studying in London will have a larger loan than those studying outside, as the cost of tuition and living costs are higher.

To find out how much money you could be entitled to and how much you’ll need to pay back, check out HEON’s student finance information.

It’s worth noting that unlike most other loans, a student loan has one of the lowest rate of interest (essentially the cost of borrowing which is added to your loan) and the repayment terms are very good – you do not pay start repaying your loan until you start earning more than £26,575.

Want to know about paying back your student loan after you graduate? Save the Student has a useful page on repayments.

BUDGETING

If you’re thinking budgeting is reserved for your parents and politicians, then think again.

Basic budgeting simply means listing the money that comes into your bank account, tracking everything that come out of your bank account and seeing how it balances out, so you can try to save money.

WORKING OUT YOUR BUDGET

1. WORK OUT YOUR INCOME

This may include a maintenance loan, money from scholarships, bursaries or grants; money from parents or caregivers, salary from a part-time job and savings. Be aware that different types of income will be paid over different periods, for example a maintenance loan will be paid out termly in three big instalments, so it’s important that you don’t use it all at once. Whereas part-time work will normally be paid monthly or weekly.

2. WORK OUT YOUR OUTGOINGS

The best way to do this is by using an app on your phone. Try to separate essential expenses (rent, bills, food shopping, travel and course materials) with non-essential expenses (clothes, going out, subscriptions, etc).

Remember that the biggest costs (tuition fees and accommodation) will usually be paid out at the start of each term so leave money aside for them each month.

3. CALCULATE YOUR WEEKLY BUDGET

- Work out your total income for a term at university

- Subtract your essential expenses for the same period

- Divide that by the number of weeks in a term.

This shows you how much money you have left to spend on non-essential things each week.

For example, if your income across the first term is £3,000 and your essential expenditure adds up to £1,500, you would have £125 a week (across a 12-week term).

By budgeting what you spend each week, you can pace your expenditure rather than spending it all at the start of the month and ending up broke by the end.

If you find you’re ending up with a deficit (you’re into your overdraft), then try to find ways to reduce your outgoings or gain more income (get a part-time job for example).

HEAR FROM OUR STUDENTS

University for the Creative Arts student Daze talks about how she keeps on top of her finances whilst at university.

Check out the apps/websites that Daze mentioned here:

- Mint (app to track your spending)

- Monzo (online student bank account)

- Alibris (second hand book website)

- Abebooks (second hand book website)

Royal Holloway student Lucy gives her budgeting tips when shopping.

OTHER USEFUL LINKS

The Next Steps – Countdown to University – UniDosh

How to save money – The Complete University Guide

Student budget calculators – Save the Student

Mobile phone apps – Money Saving Expert

Extra budgeting tips: the 9 top tips – Money Saving Expert

Money – My Surrey (a site for current University of Surrey students but open to all)

Managing your money – Royal Holloway (a site for current students but open to all)

Student Loan Repayments – Save the Student

Thank you for your attention. Please complete this short evaluation and we wish you all the best with managing your money!